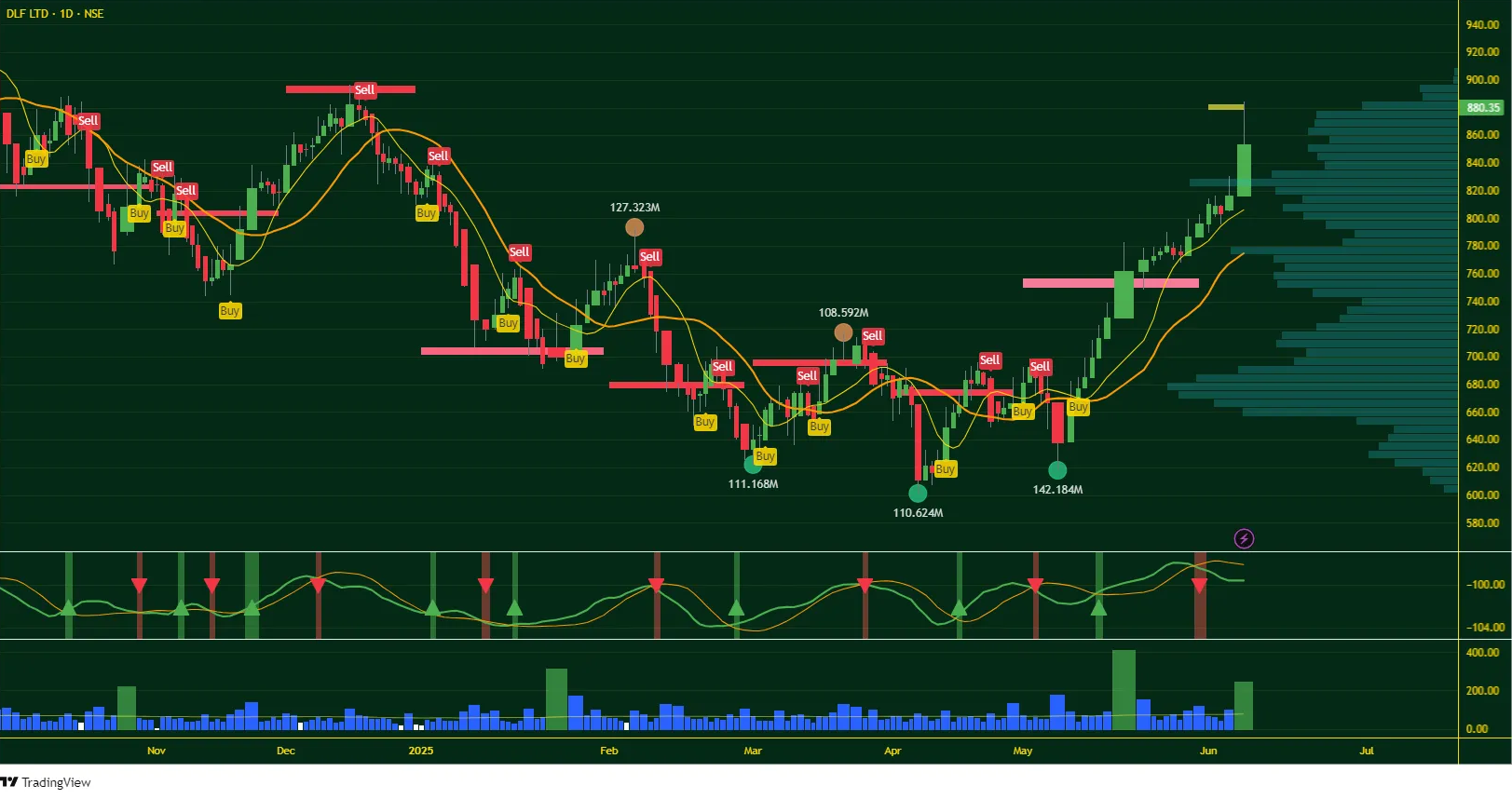

On June 7, 2025, DLF Ltd. shares surged 6.62%, closing at ₹880.35. This upward move continues a recovery trend from its low of ₹601.20 on April 7, 2025, signaling growing buyer confidence. However, the stock is now approaching a crucial resistance level that could test the strength of the current uptrend.

The current close of ₹880.35 is just shy of the December 16, 2024, high of ₹897, a moderate resistance zone. A breakout above this level could open the path toward previous highs of ₹928 and ₹969.

Buy/Sell Signals: Bullish Crossover for DLF Ltd.

A bullish crossover occurred on May 13, 2025, with the 7-period Weighted Moving Average (WMA) crossing above the 15-period Volume Weighted Moving Average (VWMA). This is a strong technical signal, especially when combined with Bullish Centre of Gravity Crossover on May 16, 2025 and volume significantly above average.

What the Charts Say – DLF Ltd.

Immediate Resistance: ₹897

Next Resistance Levels: ₹928 and ₹969 (52-week and all-time highs)

Support Levels: Watch for short-term support around ₹830–₹850 range in case of pullback

While the stock is trending upward, it hasn’t yet tested its previous peaks. Sustained buying pressure will be needed to push past these historical barriers.

Room to Grow, But Caution Ahead for DLF Ltd:

Despite the strong rally, the close at ₹880.35 is still below the intraday high and significantly below the all-time high of ₹969. This suggests:

Upside Potential: Yes, if resistance is broken

Caution: As the price nears ₹897, profit-booking or pullback risk increases

Watch ₹897 Closely

The DLF share price has shown impressive momentum, but the ₹897 resistance level will be a critical test for bulls. If the price breaks and sustains above this level, it may retest the ₹928–₹969 range in the coming sessions.

Disclaimer:

Investing and trading in financial markets involve significant risk, including the potential loss of principal. The content provided on ShortTermView.com is for educational purposes only and should not be construed as financial, legal, or investment advice. We do not endorse or recommend any securities, products, or services discussed on this site. Before making any investment decisions, you should conduct your own research and consult with a qualified financial advisor. ShortTermView.com will not be liable for any losses or damages incurred as a result of using the information provided on this website.